All Categories

Featured

Table of Contents

Term plans are additionally frequently level-premium, but the overage amount will certainly stay the exact same and not grow. The most common terms are 10, 15, 20, and 30 years, based upon the requirements of the insurance policy holder. Level-premium insurance is a sort of life insurance policy in which costs stay the same cost throughout the term, while the amount of insurance coverage provided boosts.

For a term policy, this suggests for the size of the term (e.g. 20 or 30 years); and for an irreversible plan, up until the insured passes away. Over the lengthy run, level-premium payments are usually extra cost-efficient.

They each seek a 30-year term with $1 million in coverage. Jen acquires an assured level-premium policy at around $42 monthly, with a 30-year horizon, for a total amount of $500 each year. However Beth numbers she might just require a strategy for three-to-five years or up until complete repayment of her existing financial obligations.

In year 1, she pays $240 per year, 1 and about $500 by year five. In years 2 with five, Jen remains to pay $500 per month, and Beth has paid approximately just $357 each year for the very same $1 countless insurance coverage. If Beth no much longer needs life insurance policy at year five, she will certainly have saved a whole lot of money loved one to what Jen paid.

What is Level Term Vs Decreasing Term Life Insurance? An Overview for New Buyers?

Every year as Beth grows older, she deals with ever-higher yearly costs. Jen will certainly continue to pay $500 per year. Life insurance firms have the ability to supply level-premium policies by essentially "over-charging" for the earlier years of the policy, accumulating more than what is required actuarially to cover the risk of the insured passing away during that early duration.

Long-term life insurance develops cash money value that can be borrowed. Policy car loans build up passion and unpaid policy lendings and interest will certainly decrease the survivor benefit and money worth of the plan. The quantity of money value available will typically depend on the type of permanent plan bought, the quantity of protection acquired, the length of time the policy has actually been in force and any exceptional policy fundings.

Disclosures This is a general summary of coverage. A total declaration of protection is found just in the plan. For more information on coverage, expenses, restrictions, and renewability, or to make an application for protection, call your regional State Ranch agent. Insurance plans and/or associated motorcyclists and functions may not be available in all states, and plan conditions might differ by state.

Level term life insurance coverage is the most simple method to obtain life cover. In this article, we'll describe what it is, exactly how it works and why degree term may be best for you.

What is Direct Term Life Insurance Meaning? Understand the Details

Term life insurance policy is a type of plan that lasts a certain length of time, called the term. You pick the size of the policy term when you initially get your life insurance policy. It could be 5 years, 20 years or perhaps much more. If you die throughout the pre-selected term (and you've stayed on par with your premiums), your insurance provider will certainly pay a round figure to your nominated recipients.

Navigating life insurance options can be overwhelming, especially with so many policies available. This is where working with an experienced insurance broker or agent makes all the difference. Unlike insurance agents tied to a single provider, brokers offer access to multiple life insurance options, helping you find the most suitable policy for your needs - top-rated life insurance companies from brokers. Whether it’s term life insurance for temporary coverage, whole life insurance for lifelong protection, or universal life for long-term growth, an insurance broker evaluates your unique goals and compares providers to secure the best coverage at competitive rates

For families, policies like final expense insurance, mortgage protection, and accidental death coverage offer tailored solutions to protect loved ones. Business owners can also benefit from key person insurance, ensuring continuity in the event of an unforeseen loss. With life insurance policies offering living benefits or instant coverage, brokers simplify the decision-making process and ensure your financial priorities are met.

By choosing the right insurance broker, you gain expert guidance, access to personalized recommendations, and the confidence of knowing your family or business is secure. Contact an insurance broker today to explore tailored life insurance options and secure peace of mind for the future.

Select your term and your quantity of cover. Select the policy that's right for you., you understand your costs will remain the very same throughout the term of the plan.

(Nonetheless, you don't receive any type of money back) 97% of term life insurance policy claims are paid by the insurer - SourceLife insurance policy covers most circumstances of death, but there will be some exclusions in the regards to the plan. Exemptions might include: Genetic or pre-existing conditions that you fell short to disclose at the beginning of the policyAlcohol or medicine abuseDeath while devoting a crimeAccidents while taking part in harmful sportsSuicide (some plans leave out death by suicide for the very first year of the plan) You can add important disease cover to your degree term life insurance coverage for an added cost.Crucial illness cover pays out a section of your cover amount if you are identified with a significant health problem such as cancer cells, cardiac arrest or stroke.

After this, the policy ends and the enduring partner is no much longer covered. Joint policies are usually extra budget-friendly than single life insurance coverage policies.

What Are the Terms in Term Life Insurance With Level Premiums?

This safeguards the buying power of your cover amount versus inflationLife cover is a wonderful point to have due to the fact that it gives economic security for your dependents if the most awful takes place and you die. Your liked ones can also use your life insurance policy payment to pay for your funeral. Whatever they pick to do, it's terrific comfort for you.

However, level term cover is wonderful for fulfilling day-to-day living expenditures such as household costs. You can additionally utilize your life insurance policy advantage to cover your interest-only home loan, payment home mortgage, institution fees or any type of other financial debts or recurring repayments. On the various other hand, there are some drawbacks to level cover, compared to various other kinds of life plan.

Term life insurance coverage is an affordable and straightforward alternative for many individuals. You pay costs monthly and the protection lasts for the term size, which can be 10, 15, 20, 25 or thirty years. Term life insurance with accidental death benefit. What occurs to your premium as you age depends on the kind of term life insurance policy coverage you purchase.

What is Level Premium Term Life Insurance? Key Points to Consider?

As long as you remain to pay your insurance costs monthly, you'll pay the same price during the whole term size which, for many term policies, is normally 10, 15, 20, 25 or 30 years. When the term finishes, you can either choose to finish your life insurance policy protection or restore your life insurance plan, normally at a greater rate.

A 35-year-old female in superb health and wellness can get a 30-year, $500,000 Haven Term policy, issued by MassMutual starting at $29.15 per month. Over the next 30 years, while the policy is in area, the price of the coverage will not transform over the term duration - Level term life insurance meaning. Let's face it, a lot of us don't such as for our bills to expand in time

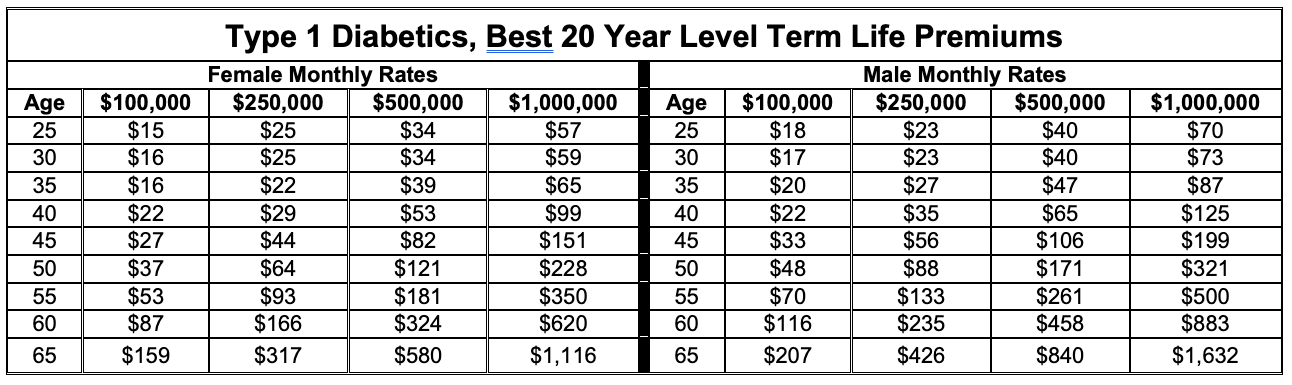

Your degree term price is figured out by a number of elements, the majority of which are connected to your age and health. Other aspects include your details term policy, insurance company, benefit quantity or payment. During the life insurance policy application procedure, you'll answer questions regarding your health history, including any pre-existing problems like a vital disease.

Latest Posts

Final Expense Services

Difference Between Burial And Life Insurance

Burial Insurance Review